Disparity in Retirement Planning Support Leaves Non-Salaried Workers Behind

Findings from Cogent Syndicated’s DC Participant Planscape™ report signal opportunity for plan providers to offer increased education and guidance to hourly and gig workers

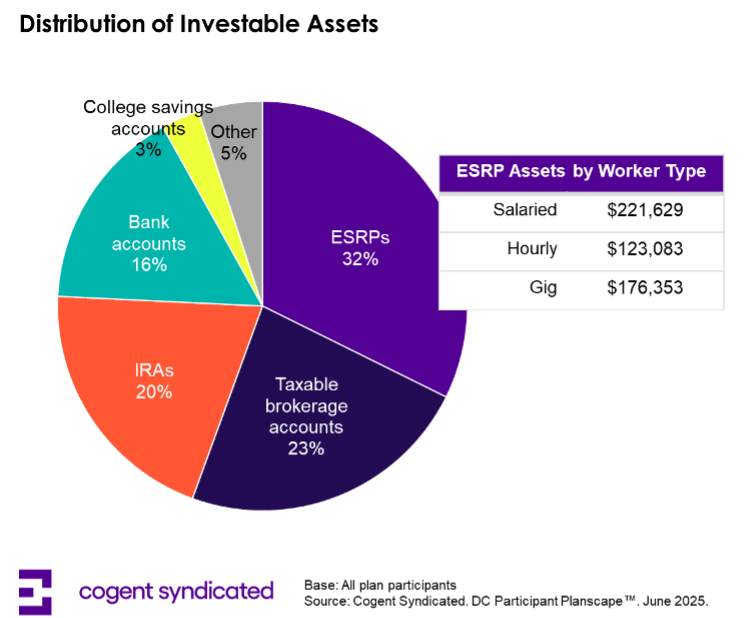

LIVONIA, Mich., Sept. 09, 2025 (GLOBE NEWSWIRE) -- Often lacking the same resources and support needed to effectively save for their future, non-salaried workers cite significantly lower employee-sponsored retirement plan (ESRP) mean account values compared with salaried workers. According to a new report from Cogent Syndicated, hourly workers report $123K in ESRP assets and gig workers report $176K while their salaried counterparts report $222K. This gap represents a significant need for increased education and guidance for non-salaried workers, especially as legislative efforts to expand access to retirement plans for these populations continue to gain momentum.

These findings come from the latest DC Participant Planscape™ report from Cogent Syndicated by Escalent, which is designed to help DC plan providers maximize participant contributions, enhance engagement and attract rollover dollars. This year, the study introduced a new income type segmentation to explore the different needs of salaried, hourly and per project “gig” workers.

The disparity seen amongst these segments can be tied not only to a lack of access to ESRPs but also to a lack of understanding and confidence in navigating the retirement planning landscape. Both hourly and gig workers are notably more fearful of losing money, 52% and 51% respectively, compared with salaried employees (46%). Just one-third (35%) of hourly workers expressed feeling confident in their ability to achieve their stated retirement goals compared with 41% of salaried and 42% of gig workers.

“If you're an hourly or gig worker, you may not have access to the breadth of education and investment guidance that salaried employees often benefit from. This presents a significant opportunity for plan providers to offer more tailored and equanimous offerings to bridge the gap in mean ESRP account values,” said Sonia Davis, lead report author and senior product director in Escalent’s Cogent Syndicated division. “It’s imperative for firms to avoid a one-size-fits-all approach and be mindful of each income type's unique preferences to spark higher contribution levels.”

Beyond higher employer-matching contributions, gig workers, in particular, reported personalized savings projections/targets, automatic contribution escalation with opt-outs, and enhanced digital capabilities as influential ways of boosting their current contribution levels. On the other hand, hourly workers are much less interested in digital capabilities and integrated AI tools when compared to their peers.

In addition, salaried and gig workers are more receptive to complimentary and fee-based employer-sponsored investment advice, citing access to employer-sponsored advice models, investment guidance during market volatility and holistic planning outside DC plans as key benefits. That said, hourly workers were quick to emphasize the advantages of having help determining how to invest their money within their retirement plan and having reduced stress from managing their finances alone.

“With expanded access to retirement plans for non-salaried workers on the horizon and a growing market for complimentary and fee-based employer-sponsored investment advice, there is a clear opening for plan providers to position themselves as a partner for long-term success,” added Linda York, a senior vice president at Cogent Syndicated.

About DC Participant Planscape™

Cogent Syndicated, a division of Escalent, conducted an online survey of a representative cross-section of 4,012 DC plan participants from June 11 to June 27, 2025. Survey participants were required to be 18 years or older and contribute at least 1% to a current plan and/or have $5,000 or more in at least one former plan. Targets were set to investor gender, region, age, education and household income using US census data filtered by the screening criteria (a market-sizing flyover survey was used to filter the US census data). The data have a margin of error of ±1.55% at the 95% confidence level. Escalent will supply the exact wording of any survey question upon request.

About Escalent

Escalent is an award-winning data analytics and advisory firm specializing in industries facing disruption and business transformation. As catalysts of progress for more than 40 years, we accelerate growth by creating a seamless flow between primary, secondary, syndicated, and internal business data, providing consulting and advisory services from insights through implementation. We are 1,600 team members strong, following the acquisition of C Space and Hall & Partners in April 2023. Escalent is headquartered in Livonia, Michigan, with locations across the US and in Australia, Canada, China, India, Ireland, the Philippines, Singapore, South Africa, UAE and the UK. Visit escalent.co to see how we are helping shape the brands that are reshaping the world.

CONTACT: Kim Eberhardt

248.417.2460

keberhardt@identitypr.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/67d28934-ef36-449c-a897-b6a50adb17f7

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.